Phoenix Wrongful

Death Lawyers

EXPERIENCE. STRAIGHT TALK. JUSTICE.

99% Success Rate

550+ 5-Star Reviews

$0 Fee Unless We Win

Meet Marc Lamber

99%!

Won or Settled*99% Success Rate.

Over 550 5 Star Reviews

0$

No Fee PromiseNo fee unless you get paid.

We are the legal experts the media calls

Lamber Goodnow Injury Lawyers

Phoenix Office

Phoenix Wrongful Death Attorneys

We hope you never need a wrongful death lawyer in Phoenix or elsewhere. But, if you do, we’ll help you through your grief with compassionate care. Count on us to seek justice and accountability.

Justin McKay on Seeking Justice

“The enormous pain and loss from a wrongful death is something no one can truly prepare for. In these cases, we honor the memory of lost family members by pursuing maximum compensation from those responsible. Our fierce tactics help our clients move forward with dignity and deter the negligent conduct from happening again in the future.”

In an instant, your world can be turned upside down with the loss of a loved one.

Suffering the death of a spouse or family member is devastating and many times leaves survivors at a complete loss on how to move forward. If that loss was due to the negligence of another person, business or government agency, Arizona tort law allows the family of a deceased to seek justice and financial compensation through a wrongful death lawsuit. The law recognizes that the negligent person’s liability extends past the death of the deceased. In no way will financial compensation replace the loss of a loved one, but it may help ease the stress associated with the family’s financial burdens. The Lamber Goodnow Injury Lawyers team has years of experience advocating for clients in their efforts to hold those responsible for the deaths of their loved ones liable for their negligence.

What is a Wrongful Death Lawsuit?

When a person dies due to a wrongful act, neglect or misconduct of another, certain surviving members of the victim’s family may bring a wrongful death lawsuit in civil court. According to A.R.S. Section 12-611, a wrongful death suit may be brought to court if the deceased person could have filed a personal injury case based on the negligent or wrongful conduct that caused their death. Another way to look at a wrongful death claim is that it is akin to a personal injury case in which the injured person is no longer able to bring the case on their own behalf; therefore, certain family members may seek justice through a wrongful death claim.

In order to have a successful a wrongful death lawsuit, the family member initiating the lawsuit has the burden of establishing that the defendant acted negligently and that their negligence was the proximate cause of the death of their loved one. Proximate cause means an event that is sufficiently related to an injury to make the courts deem that the event is the cause of that injury.

Many wrongful death lawsuits follow criminal trials. Wrongful death lawsuits may use similar evidence as criminal trials, however, the standard of proof in a wrongful death civil trial is different than that of a criminal trial. In a criminal trial the prosecution must establish the wrongdoer’s guilt beyond a reasonable doubt. This means that the evidence against the wrongdoer is fully satisfied, that all the facts have been proven and that the guilt of the wrongdoer has been established. In a civil trial the family members must prove that the wrongdoer was responsible by a preponderance of the evidence. This means that the evidence that the family presents showing the wrongdoer’s negligence caused the death of their loved one was more probable than not. Additionally, a defendant found guilty in criminal court goes to prison, while a defendant found guilty in civil court must pay monetary damages. A person convicted of wrongful death may or may not be convicted of a crime associated with that death.

Required Elements of a Wrongful Death Lawsuit

In order to bring a successful wrongful death claim in Arizona, the following elements must be present:

Negligence

The surviving family members must prove that the death of their loved one was caused by the wrongful act, neglect or default of the defendant.

Breach of Duty

The defendant owed a duty to the decedent. For example, in a motor vehicle death, the defendant owed a duty to the decedent to drive safely and to follow all traffic laws.

Causation

The surviving family members must prove how the defendant’s negligence caused their loved one’s death.

Damages

The death of the victim must have generated quantifiable damages such as medical bills, loss of earnings, funeral and burial costs and pain and suffering.

Who is Entitled to Initiate an Arizona Wrongful Death Lawsuit?

Under A.R.S. Section 12-612(A), an action for wrongful death shall be brought by and in the name of the surviving:

- Husband or Wife;

- Children, both natural and adopted;

- Natural Parents, Adoptive Parents, or Guardian; or

- Personal Representative of the deceased person for and on behalf of the surviving husband or wife, child, parents, or if none of these survive, on behalf of the decedent’s estate.

Additionally, either parent may maintain a wrongful death action for the death of a child.

Under Arizona law, however, if any family member who would have been eligible to file a wrongful death lawsuit or benefit from damages awarded by a wrongful death lawsuit, is found guilty under A.R.S. Section 13-3623 (child or vulnerable adult abuse), or A.R.S. Sections 13-1103-1105 (manslaughter, second degree murder and first-degree murder), the law treats the family member as having predeceased the decedent and therefore disqualifies them from recovering benefits. This portion of the Arizona wrongful death law eliminates a loophole that, in the past, had allowed family members who had caused the wrongful death to benefit from a wrongful death lawsuit.

Basis for Reducing Damages in a Wrongful Death Case

Although the family may receive an award of damages in a wrongful death case, their damages may also be reduced by certain actions that occurred during the decedent’s life. An example is if a husband abused his wife while she was alive. This may be shown to reduce damages because it may prove that the husband did not suffer as a result of her wrongful death.[4]

The courts have addressed a number of factors which may reduce the amount of damages the beneficiaries receive in a wrongful death action. Arizona law, however, provides that evidence of remarriage of a surviving spouse is not admissible to reduce damages.[5] The reason behind this rule is that a defendant should not benefit from the fact that a surviving spouse has remarried.

Survival Actions

A survival statute preserves an injured party’s right to recover for personal injury after the victim dies. In a survival action the victim’s estate assumes the victim’s claim against the negligent party. Survival statutes vary from state to state, but they generally allow the estate to sue for damages, pain and suffering, but not wrongful death. A survival action is completely separate from a wrongful death action and arises out of the original injury and not out of death.

Under A.R.S. Section 14-3110, the estate may sue for every cause of action, except:

- Damages for breach of promise to marry

- Seduction

- Libel

- Slander

- Separate Maintenance

- Alimony

- Loss of Consortium

- Invasion of the right to privacy

The purpose of providing both causes of action is to give and preserve to the parties damaged, a complete remedy and an opportunity to recover the complete loss sustained because of the wrongful injury or death.

Lamber Goodnow Injury Lawyers has experience litigating both wrongful death and survival claims and will work closely with our clients to make sure the correct action is taken in order to get our clients the remedies they deserve.

Wrongful Death Damage Recovery and Taxes

According to the IRS Publication 4345, wrongful death suits are under the same category as personal injury settlements. Both of these are generally non-taxable since they are seen as compensatory—or refunding the person for money lost. Any monies that were received due to a physical injury and as a consequence caused emotional or mental hardship, those are then labeled as medical expenses (compensatory) and therefore are non-taxable.

There are conditions, however, in which medical expenses are taxable. If the medical expense amount had already been labeled as a deduction in any prior tax returns, then the settlement must be labeled as income.

Any punitive damage monies received are not categorized as compensatory and instead are seen as financial awards which must be reported as “other income” on line 21 of Form 1040 in your taxes. Punitive damages are monies that go beyond the medical costs incurred due to the accident and wrongful death.

The Small Business Job Protection Act of 1996 amended 26 U.S.C. § 104(a)(2) to provide that damages (other than punitive damages) received under a judgment or settlement of a claim for personal injury or sickness are excludible from gross income. The legislative history of the 1996 Act makes clear that this exception includes income received from a wrongful death claim.[6]

Deadlines to File a Wrongful Death Lawsuit in Arizona

Every state has certain deadlines in which a family or an estate must file a lawsuit over a wrongful death. These deadlines are called a statute of limitations because it is a time deadline set by state law. The deadline from a wrongful death lawsuit to be filed is not affected by any criminal case that may also be filed in relation to the death.

In Arizona, under A.R.S. Section 12-542(2), barring unusual circumstances, a wrongful death lawsuit must be filed within two years of the date of the deceased person’s death.[7]

The Discovery Rule

Many courts believe that if the application of the limitation period would destroy the cause of action before it can be discovered the discovery rule should be applied.

The discovery rule states that the running of a limitations period in a wrongful death action begins when the party that is bringing the lawsuit discovers, or should have discovered through reasonable diligence, the cause of the decedent’s death. Arizona applies the discovery rule.[8]

Motor Vehicle Wrongful Death Claims

The National Safety Council estimates that in 2021, more than 46,020 people lost their lives in motor vehicle accidents.

In Arizona, 970 people were killed in motor vehicle accidents during 2020 according to the Arizona Department of Transportation.

Wrongful death lawsuits may arise from various types of vehicle accidents including:

- Fatal Car Accidents

- Motorcycle Fatalities

- Fatal Bicycle Accidents

- Boating Accidents

- Drunk Driving Accidents

- Truck Accidents

- Airplane Accidents

- Bus Accidents

Wrongful Death Resources

Although meeting with an experienced Phoenix wrongful death attorney is imperative if your loved one has been killed due to the negligence of another, it is also important that you have resources in order to educate yourself on the negligence of others.

- Consumer Product Safety Commission: Provides information on consumer product recalls and other safety resources, including information on pool safety, baby cribs, carbon monoxide, and other household causes of accidental death.

- Medline Plus: Injuries and Wounds: From the National Library of Medicine, alphabetically arranged resources on injuries and wounds.

- National Highway Traffic Safety Administration: Provides information on highway safety and fatalities, with special sections on drunk driving, distracted driving, and other key issues.

- National Institute for Occupational Safety and Health (NIOSH): Comprehensive information on workplace safety, such as emergency preparedness, chemical exposure, and more.

- National Patient Safety Foundation: Features patient safety resources and literature, covering a wide range of medical topics, such as ways to prevent infections in hospitals and pharmacy safety.

FAQs

It is unfortunate that some accidents can cause catastrophic injuries, up to and including deaths.

When fatalities happen because of the negligence or intentional actions of other people or entities, certain family members of the decedents may file civil lawsuits against the parties that are responsible for causing the deaths of their loved ones. This area of law falls under tort law, and the lawsuits are civil actions.

Here are some frequently asked questions about wrongful death.

Q: What is a wrongful death case?

A: A claim involving a death caused by negligence, recklessness, or intentional acts is a type of personal injury lawsuit that can be filed when someone is killed as a result of the actions of somebody else. Under A.R.S. § 12-611, the death of a person that is caused by the neglect or wrongful conduct of another person or entity gives rise to the ability to file a death action against the person or entity that is responsible. People are able to file lawsuits if the person who died would have been able to file a personal injury claim if he or she had not succumbed to his or her injuries.

Historically, when people died, the ability to file tort claims for the wrongs that were done to them died with them. The common law did not recognize the ability of a person to file an action against someone else who was responsible for the death of a loved one. Legislatures across the U.S. recognized that this was inherently wrong and enacted statutes to allow certain family members to file lawsuits against the parties who are responsible for the deaths of their loved ones. This means that death actions in the U.S. are statutory creations. Like other states, Arizona has codified the ability to file this type of tort lawsuit in its statutory laws.

Q: Who is allowed to file a lawsuit involving a death?

A: A death action cannot be filed by just anyone. Under A.R.S. § 12-612, only specific people can file a lawsuit against a defendant who caused the death of their loved one. The lawsuit must be filed by and for the benefit of the following parties:

- The surviving spouse

- A surviving child of the decedent

- The guardian or parent of the decedent

- The personal representative of the decedent on behalf of the surviving spouse, child, or parent

- The personal representative of the estate on the estate’s behalf if none of these people survive the decedent

In general, this list of people who are allowed to file a lawsuit will move in order of precedence from a surviving spouse down to the personal representative. If a party with more precedence exists, he or she must file the lawsuit. For example, if the deceased person left behind both a spouse and a child, the spouse should file the lawsuit.

Q: Do you have to pay income taxes on awards or settlements in cases involving death?

A: According to the IRS in Publication 4345, damages for claims involving death are considered to be compensation for physical injuries. They are generally free from income tax for the survivors. However, it is important to note that if your loved one left a sizeable estate, damages in this type of lawsuit might push the value of the estate above the federal estate tax exemption. Arizona does not have an estate tax. The federal exemption may still apply if your loved one’s estate was worth more than $11.18 million. Most people will not need to worry about this issue.

If you receive punitive damages, you may be required to report them as income on your income tax return. Finally, if your settlement agreement contains a nondisclosure clause, the IRS can claim that it was bargained for and make all of the award subject to taxation. You should avoid signing an agreement that contains a nondisclosure clause unless you secure an agreement from the defendant that he or she will defend against the IRS and indemnify you if you are charged taxes on your settlement.

Q: What is the difference between a survival action and a death claim?

A: A survival action is distinct from a claim for wrongful death. Under A.R.S. § 14-3110, the personal representative of a decedent’s estate can file a survival action against a defendant for a cause of action that the decedent could have filed if he or she had survived. However, survival actions do not allow for the recovery of pain and suffering damages or for loss of consortium.

Survival actions have to be brought by the estate of the deceased person rather than by a family member unless the family member is also the personal representative of the estate. The lawsuit is for the benefit of the estate. When a settlement or verdict award is secured in a survival action, the proceeds will be deposited with the estate. When the estate is distributed among the estate beneficiaries, the money will ultimately benefit each of them. Survival actions are brought on behalf of the deceased person for his or her personal losses. A death action is brought on behalf of the surviving family members to recover their own losses. In some cases, it is possible for there to be grounds to file both a death claim and a survival action.

Q: Who is responsible for paying damages in a settlement involving a death?

A: When a lawsuit is filed against a defendant for the death of your loved one, the insurance company for the defendant will normally be responsible for paying the damages that are agreed to in a settlement or that are awarded by a jury. For example, if your loved one was killed in an accident involving a commercial truck, the trucking company’s insurance carrier will likely be responsible for paying the damages.

If your loved one was killed in an accident with another motorist, the at-fault driver’s insurance company will be responsible for paying any damages that you are able to recover up to the policy limits. If your loved one was killed because of a defective product, the manufacturer, designer, and others that were involved in the chain of production may be responsible for paying damages. In some cases, the defendants will not have sufficient insurance coverage to pay the damages that are awarded. It is possible to go after the defendants’ assets to try to secure payment for any damages that the insurance companies do not cover. In most cases, however, the recovery will be limited to the policy limits of the available insurance policies.

Q: What damages are available in a wrongful death lawsuit?

A: The particular amounts that might be recoverable in a wrongful death lawsuit will depend on the facts and circumstances of what occurred. Similar to injury claims, the potential damages can be divided into categories of damages called general damages and special damages. Special damages are monetary amounts to compensate the family members for their actual economic losses from the loss of their loved one. These might include the following types of damages:

- Medical expenses incurred for caring for your loved one until he or she succumbed to his or her injuries

- Your loved one’s past lost income and future income losses based on a life expectancy chart, your loved one’s education and career, and his or her future earnings potential

- Loss of the value of the contributions through services that a non-working spouse made to the home and family

- Your loved one’s lost rights to an inheritance

- Property losses

General damages are damages that are more intangible. In a wrongful death case, these might include the following:

- Pain and suffering that your loved one experienced after his or her injury up until he or she died

- Your emotional trauma experienced from seeing your loved one die

- Your grief

- Loss of consortium for spouses

- Loss of guidance for children

Punitive damages are generally not recoverable in wrongful death cases.

Q: Will the damages that I receive in a wrongful death lawsuit be subject to the debts of my loved one?

A: Whether the proceeds from a wrongful death lawsuit may be reached by the creditors of your loved one will depend on the party who brings it. Under A.R.S. § 12-613, proceeds from wrongful death claims cannot be used to pay the debts of a decedent when the lawsuits are brought by and for the immediate family members of the decedent. However, when the claim is brought by the personal representative for the estate, the proceeds will go to the estate. The creditors are then allowed to file claims against the estate to recover the money that they are owed.

Q: What types of damages are available in an action involving a death?

A: The damages that might be available in a case involving death can be divided into special and general damages. Special damages are the actual pecuniary losses that you have suffered because of the death of your loved one and might include the following types:

- Burial costs

- Funeral costs

- Loss of your loved one’s income

- Lost rights to an inheritance

- Property losses

General damages are damages that are difficult to place a value on and might include the following:

- Physical pain and suffering experienced by your loved one until he or she died

- Emotional trauma

- Loss of consortium or guidance

- Grief

Under A.R.S. § 12-613, juries are instructed to award damages that they believe are fair and just. The damages that are awarded in these types of cases are not subject to any claims by the creditors of your loved one unless the estate brings the lawsuit.

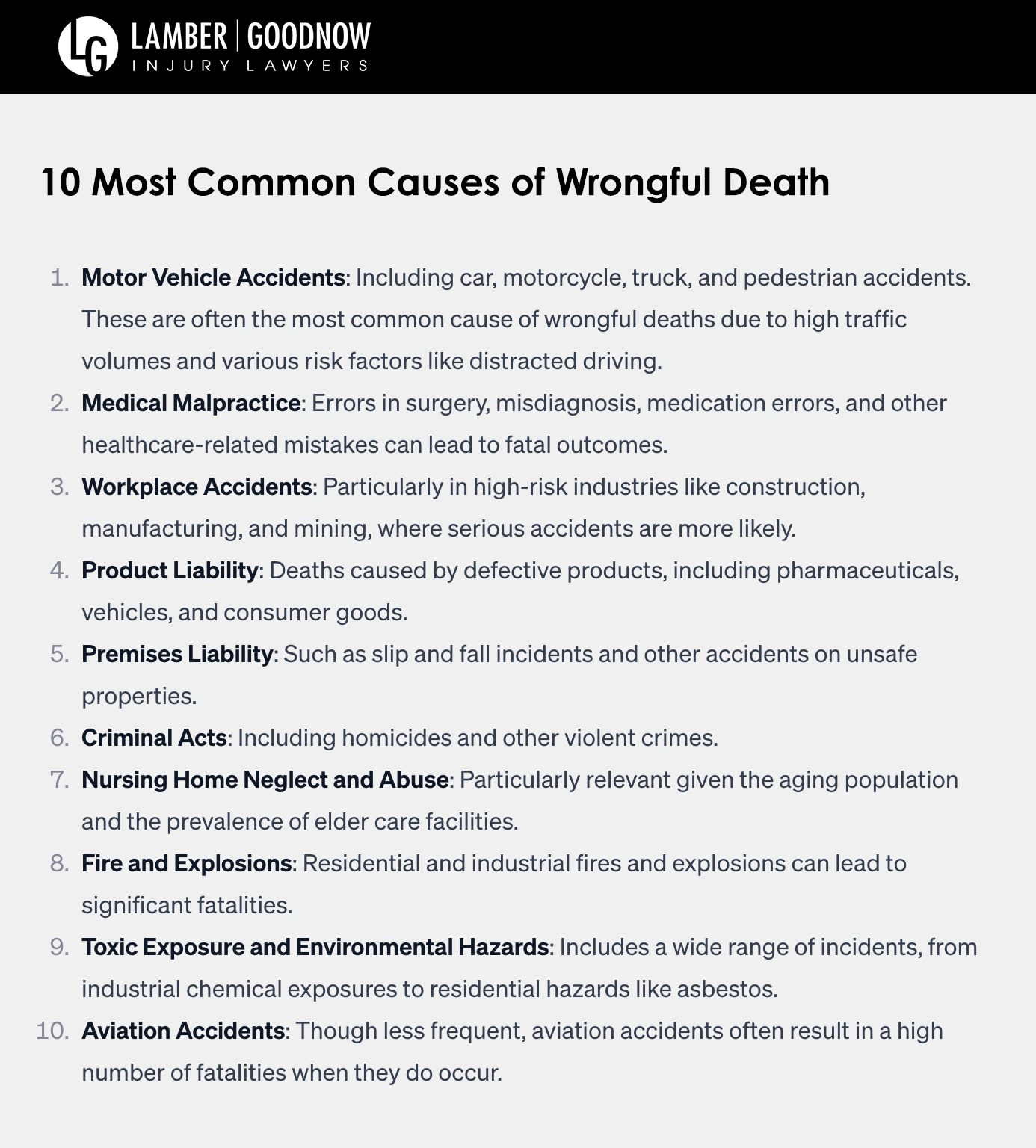

Q: What are the most common types of cases involving deaths that are wrongful?

A: Death actions can arise in many different situations. Some of the most common types include the following:

- Automobile, truck, and motorcycle accidents

- Workplace deaths

- Deaths caused by medical errors

- Deaths resulting from defective products

- Deaths resulting from nursing home neglect or abuse

- Construction accidents

- Deaths from violence

If your loved one was killed because of the negligent acts, omissions, or intentional conduct of another person or entity, you may have grounds to file a lawsuit. The attorneys at Lamber Goodnow can review the circumstances of what happened and talk to you about whether you have a legal basis to file a lawsuit.

Q: Can colleges or universities be liable for college student murders?

A: Whether a university or college might be liable for the murder of a college student will be fact dependent. In some cases, an institution of higher education may be liable when a murder occurs. For example, if the university provided inadequate security on campus or in a dormitory, it may be liable for a resulting death. A college might also be liable if it knew or had reason to know about a student’s propensity for violence combined with threats to harm a particular student if it failed to warn the victim of the threats. The attorneys at Lamber Goodnow can analyze the facts to determine all of the parties that should be named as defendants to a lawsuit.

Q: What is the statute of limitations for filing a case involving a death?

A: All states have limitations periods within which actions must be filed. These limitations periods serve as time limits for filing lawsuits. If you fail to file a lawsuit within the statutory time period, you will lose your ability to file a claim to recover damages. Under A.R.S. § 12-542, a civil lawsuit for the death of a loved one must be filed within two years of when the death occurs.

It is important to note that while you have two years to file a lawsuit for the death of your loved one, it is best for you to talk to an attorney much sooner instead of waiting until you are close to the end of the limitations period. Getting help soon after your loved one’s accident and death can help to preserve evidence that could otherwise be lost as time passes. It can also give your lawyer more time to conduct a thorough investigation so that the claim might be stronger than it might be if you wait.

Q: Why file a civil action when a criminal case is pending?

A: Some people do not understand why they should file a civil lawsuit against a defendant who is responsible for the death of their loved one when there is already a criminal case pending against the defendant. There are a couple of reasons why it is important for you to file a civil lawsuit regardless of whether a criminal case has been filed.

Criminal cases have a higher burden of proof. Prosecutors are required to prove that the defendants are guilty beyond a reasonable doubt. By contrast, plaintiffs in civil cases must prove that the defendants were more likely than not to have committed the offense.

This means that it may be possible for you to prevail in your civil claim against the person or entity that is responsible for causing your loved one’s death even if the defendant is not criminally charged or is found not guilty in his or her criminal case. A famous example of this is the O.J. Simpson case. While Simpson was found not guilty in his criminal case for the murder of Nicole Brown Simpson, he was found to be responsible in the civil lawsuit that was filed by her family and by the family of Ronald Goldman. Filing a civil lawsuit can help you to hold the defendant accountable for his or her actions.

[2] Taylor v. Southern Pacific Transportation Co., 130 Ariz. 516, 637 P.2d 726 (1981).

[3] H.R. Conf. Rep. No. 104-737, 104th Cong. 2d Sess., 301 (1996).

[4] Rogers v. Smith Kline & French Laboratories, 5 Ariz. App. 553, 429 P.2d 4 (1967).

[5] Lawhon v. L.B.J. Institutional Supply, 159 Ariz. 179, 765 P.2d 1003 (App. 1988) (cause of action does not accrue until plaintiff knows he has been negligently injured by a particular defendant).

Locations

Lamber Goodnow Injury Lawyers

Phoenix, Arizona

602-ARIZONA (602-274-9662)

2394 E Camelback Rd #600

Phoenix, AZ 85016

Lamber Goodnow Injury Lawyers

Denver, Colorado

303-800-8888

1330 Logan St Suite B2,

Denver, CO 80203

Lamber Goodnow Injury Lawyers

Tucson, Arizona

520-477-7777

4023 E. Grant Rd Suite 101,

Tucson AZ 85712.